Inflation is a key economic factor that global businesses cannot afford to ignore. It affects everything from production costs to consumer behavior, and its impact varies across countries and industries. As businesses navigate an increasingly interconnected global market, understanding the different types of inflation and their consequences becomes crucial. In this article, we’ll explore the various types of inflation, how they affect businesses, and strategies for managing them in a global context.

What is Inflation and Why Does It Matter?

Inflation refers to the rise in prices of goods and services over time, which reduces the purchasing power of money. For businesses, inflation affects both operational costs and the prices consumers are willing to pay. While moderate inflation can signal a healthy economy, excessive inflation can lead to instability and hinder economic growth.

In a globalized world, inflation isn’t a local issue—it can reverberate across borders, affecting supply chains, consumer demand, and investment strategies. Understanding the different types of inflation helps businesses anticipate risks and make informed decisions.

The Inflation Landscape in 2025

As we navigate through 2025, inflation continues to play a central role in shaping the global business environment. The economic aftermath of the pandemic, combined with rising energy costs, ongoing geopolitical tensions, and persistent supply chain disruptions, has created a challenging landscape for businesses worldwide.

According to the World Economic Outlook, published by the International Monetary Fund in January 2025, global growth is projected to hold at 3.3 percent for both 2025 and 2026. This figure falls short of the 3.7 percent historical average recorded from 2000 to 2019, highlighting a slower-than-usual recovery. The muted growth outlook underscores the fragility of the current global economy and amplifies the impact of inflation across markets, influencing everything from operational costs to consumer behavior.

Why Inflation Is a Key Issue for Businesses in 2025

Inflation is no longer just an abstract economic concern—it is a pervasive force with real-time consequences for global markets. Here’s why businesses cannot afford to ignore inflation in 2025:

Persistent Supply Chain Disruptions:

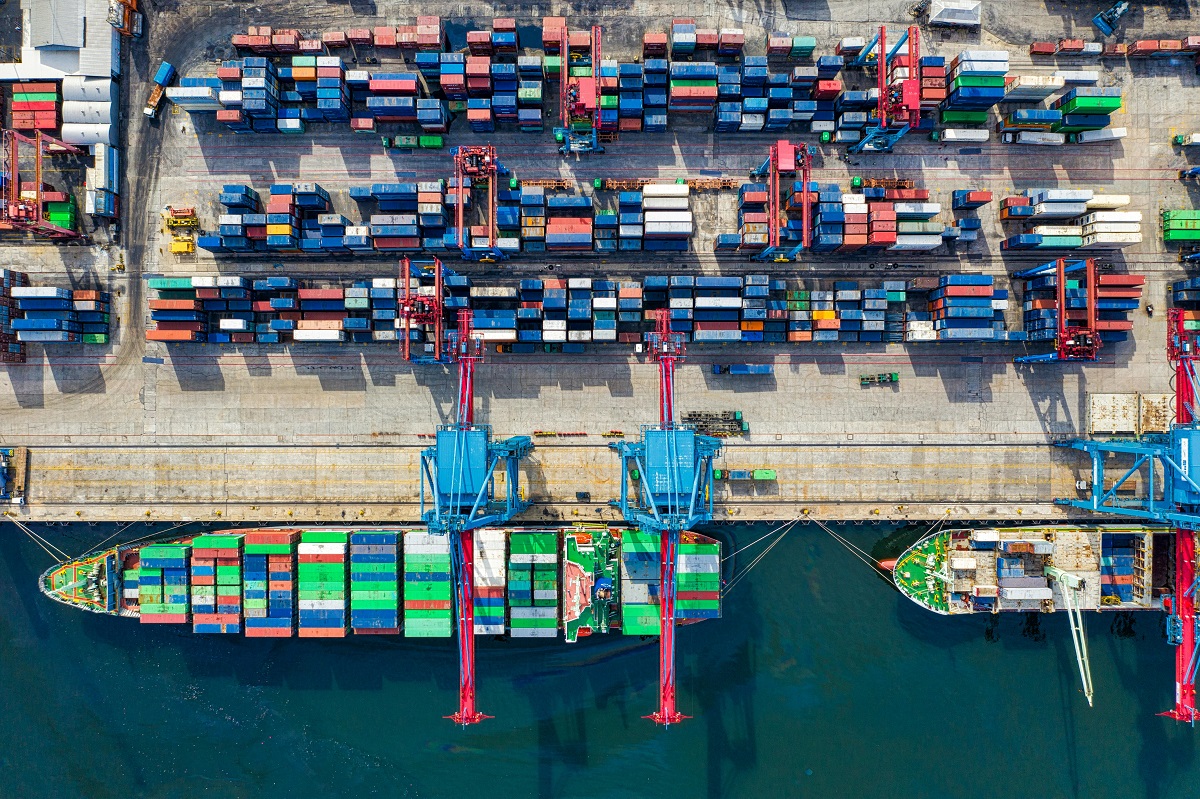

Ongoing disruptions in global supply chains—exacerbated by geopolitical tensions, labor shortages, and transportation issues—continue to drive up production costs. Many businesses are paying more for raw materials and facing delays in receiving goods, compounding the inflationary pressures.

Energy Prices and Environmental Transition:

The global transition to renewable energy sources and the volatility of fossil fuel markets have added complexity to energy prices. For many industries, energy remains a key input, and fluctuations in energy prices can have immediate and long-term inflationary effects. At the same time, investments in green technologies are pushing up the costs of new infrastructure.

Labor Market Tightness:

In many countries, the labor market is still recovering from the shocks of the pandemic. As a result, wage inflation is becoming a growing concern, particularly in sectors requiring specialized skills or where demand for workers outpaces supply. Higher wages lead to increased operational costs, which businesses must either absorb or pass on to consumers through higher prices.

Monetary Policies and Interest Rates:

To control inflation, central banks in many countries have raised interest rates to curb demand and stabilize prices. However, these higher interest rates can create a ripple effect on borrowing costs, reducing investment in new projects and innovations. Businesses that rely on credit for expansion or operational financing may find themselves under pressure from rising financing costs.

The Different Types of Inflation

Inflation doesn’t occur uniformly. Economists categorize it into several types, each with its own set of causes and effects. Here are the main types of inflation that businesses should be aware of:

1. Demand-Pull Inflation: The Economy Overheats

Demand-pull inflation happens when the demand for goods and services exceeds supply. It is often described as “too much money chasing too few goods.” When the economy grows rapidly, businesses may struggle to meet the increased demand, driving prices up. This type of inflation is typically associated with periods of economic expansion.

What Causes Demand-Pull Inflation?

- Economic booms and increased consumer spending.

- Government spending and fiscal stimulus.

- A surge in investment activities.

- Increased demand in the global marketplace.

Consequences for Global Businesses:

- Rising production costs: As demand exceeds supply, businesses face higher input costs, which could lead to increased prices for products and services.

- Supply chain strain: Global supply chains may be unable to keep up with demand, leading to delays and price increases.

- Currency fluctuations: If demand for a country’s exports rises, its currency may strengthen, making international transactions more expensive for foreign buyers.

2. Cost-Push Inflation: Rising Production Costs

Cost-push inflation occurs when the costs of production increase, leading businesses to raise prices to maintain profit margins. These cost increases can come from various sources, including higher wages, rising raw material prices, or increased energy costs.

What Causes Cost-Push Inflation?

- Increased labor costs: High wages, often resulting from union negotiations or labor shortages.

- Rising commodity prices: Increases in the prices of raw materials like oil, metals, or agricultural products.

- Supply chain disruptions: When global supply chains are interrupted, such as due to geopolitical instability or natural disasters, businesses face higher procurement costs.

Consequences for Global Businesses:

- Reduced profit margins: Higher input costs may erode the profitability of businesses, especially those with thin margins.

- Price increases for consumers: To maintain profitability, businesses may pass these costs on to consumers, raising the prices of goods and services.

- Market competition: Companies may struggle to remain competitive if their cost increases outpace those of competitors, leading to market share loss.

3. Built-In Inflation: The Wage-Price Spiral

Built-in inflation, also known as wage-price inflation, is a self-perpetuating cycle where businesses raise prices to compensate for higher wages, and workers demand higher wages to keep up with rising prices. This feedback loop causes prices to continually rise, even in the absence of increased demand.

What Causes Built-In Inflation?

- Expectation of inflation: As consumers and workers anticipate rising prices, they adjust their behavior, causing inflationary pressures to build.

- Wage demands: Employees demand higher wages to keep up with the cost of living, leading businesses to raise prices in turn.

- Price-wage spiral: This cycle continues as each round of wage increases leads to higher prices, which in turn leads to further wage demands.

Consequences for Global Businesses:

- Labor market pressure: Businesses may face pressure to increase wages to retain employees, leading to higher operational costs.

- Consumer price sensitivity: Rising prices can reduce consumer purchasing power, impacting demand for goods and services.

- Increased costs across the economy: The self-reinforcing nature of built-in inflation means that it can persist longer than other types of inflation.

How Do These Types of Inflation Affect Global Businesses?

Global Supply Chains: Strained and Vulnerable

Global businesses that rely on international supply chains are particularly vulnerable to inflationary pressures. Cost-push inflation can drive up the cost of raw materials, while demand-pull inflation may cause shortages in key components.

Strategies to Manage Inflationary Risks in Supply Chains:

- Diversify suppliers: Relying on a single supplier can increase vulnerability. Businesses should diversify their supplier base to mitigate the risks associated with inflation.

- Invest in technology: Automation and digital tools can help businesses improve efficiency and reduce reliance on labor-intensive processes, cushioning the impact of rising labor costs.

- Monitor global trends: Stay informed about inflationary pressures in key markets and adjust sourcing strategies accordingly.

Currency Volatility: Impact on International Transactions

Inflation often leads to currency fluctuations, which can affect businesses engaged in international trade. A rising domestic inflation rate may lead to currency depreciation, making imports more expensive and exports cheaper.

How Currency Volatility Affects Businesses:

- Increased import costs: A weaker domestic currency can drive up the cost of importing raw materials and goods.

- Export opportunities: Conversely, a weaker currency can make a country’s exports more competitive in the global market, leading to increased demand.

Strategies to Manage Currency Risks:

- Hedge currency risk: Businesses can use financial instruments like forward contracts and options to hedge against currency fluctuations.

- Localize production: Establishing production facilities in foreign markets can help mitigate the impact of currency volatility.

Consumer Behavior: Changing Demand Patterns

Inflation affects consumer purchasing power. As prices rise, consumers may cut back on spending, prioritize necessities, and seek value-oriented products. This shift in consumer behavior can have significant consequences for global businesses.

How Inflation Affects Consumer Behavior:

- Demand for premium goods may drop: As inflation increases, consumers are more likely to reduce spending on luxury or non-essential items.

- Shift to cost-effective alternatives: Price-conscious consumers may seek out alternatives, including generic or off-brand products.

- Focus on essentials: Spending on discretionary items may decrease, while demand for necessities like food, fuel, and utilities could rise.

Strategies for Adapting to Changing Consumer Demand:

- Focus on value: Offering products and services that emphasize value for money can help businesses retain customers during inflationary periods.

- Segment your market: Understanding how different consumer segments are impacted by inflation can help businesses tailor their offerings to different market needs.

- Promote loyalty programs: Incentivizing repeat purchases through loyalty programs can help businesses retain customers during uncertain economic times.

How Can Global Businesses Prepare for and Navigate Inflation?

While inflation is often beyond a business’s control, there are strategies that can help mitigate its negative effects. Here are some key approaches businesses can use to prepare for and navigate inflation:

1. Cost Management Strategies

- Review cost structures: Businesses should regularly review their cost structures to identify areas where savings can be made. For example, renegotiating supplier contracts or optimizing production processes can help offset rising costs.

- Automate processes: Investing in automation and technology can reduce reliance on labor, which can help manage rising wage costs.

2. Price Adjustments and Strategic Pricing

- Implement strategic price increases: Businesses may need to raise prices to compensate for rising costs. However, it is essential to be strategic in how prices are adjusted to avoid alienating consumers.

- Offer tiered pricing: Offering products in different price ranges can help businesses cater to a broader range of consumers during inflationary periods.

3. Financial Hedging and Risk Management

- Utilize hedging instruments: Businesses can use financial tools to hedge against commodity price fluctuations, currency volatility, and interest rate changes.

- Build financial resilience: Building up cash reserves during non-inflationary periods can provide a buffer against rising costs.

Conclusion: Inflation’s Long-Term Consequences for Global Businesses

Inflation is an inevitable part of the global economic landscape. While it can create challenges for businesses, understanding its various types and the broader consequences of inflation helps organizations take proactive steps to mitigate risk. By adapting supply chains, adjusting pricing strategies, and managing costs effectively, global businesses can weather inflationary pressures and emerge more resilient in the face of economic uncertainty.